Banglarbhumi 2025: Updated Document Fees, Rates and Charges

Navigating land records and property services in West Bengal can be complex, but understanding the document fees and associated charges can simplify the process. Here’s a breakdown of the updated Banglarbhumi document fees and service charges as of 2025.

Property Registration Charges

Mutation Application Fees

- Rural Areas: ₹40 per decimal

- Municipal Areas: ₹60 per decimal

- Kolkata Metropolitan Development Authority (KMDA) Areas: ₹80 per decimal

- Rural Areas: ₹100 per decimal

- Municipal Areas: ₹150 per decimal

- KMDA Areas: ₹200 per decimal

- Rural Areas: ₹500 per decimal (up to 10 decimals); ₹1,000 per decimal

- Municipal Areas: ₹1,500 per decimal (up to 10 decimals); ₹3,000 per decimal (over 10 decimals)

- KMDA Areas: ₹5,000 per decimal (up to 10 decimals); ₹10,000 per decimal

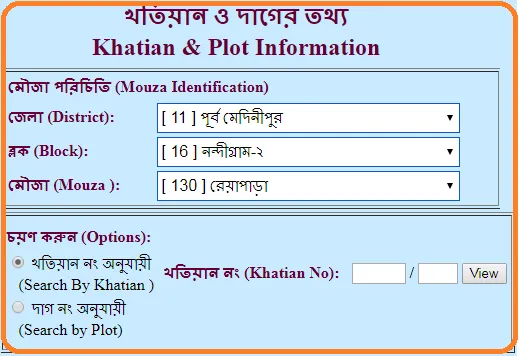

Certified Copies of Land Records

Record of Rights (RoR), Plot Information, Mouza Map:

Fees vary based on the type of document and the area. Specific charges can be found on the Banglarbhumi portal under the “Fee Payment” section.You can also understand RS-LR plot information with our complete guide: RS-LR Plot 2025, Must-Know Guide for WB Landowners.

Land Conversion Application Fees

Application Fee: ₹10 for all land conversion applications.

Conversion Fee:

1.Rural Areas:

Allied to Agriculture: ₹15 per decimal

Industrial/Commercial: ₹50 per decimal

2.Municipal & KMDA Areas

Fees vary; specific rates can be checked on the Banglarbhumi portal.

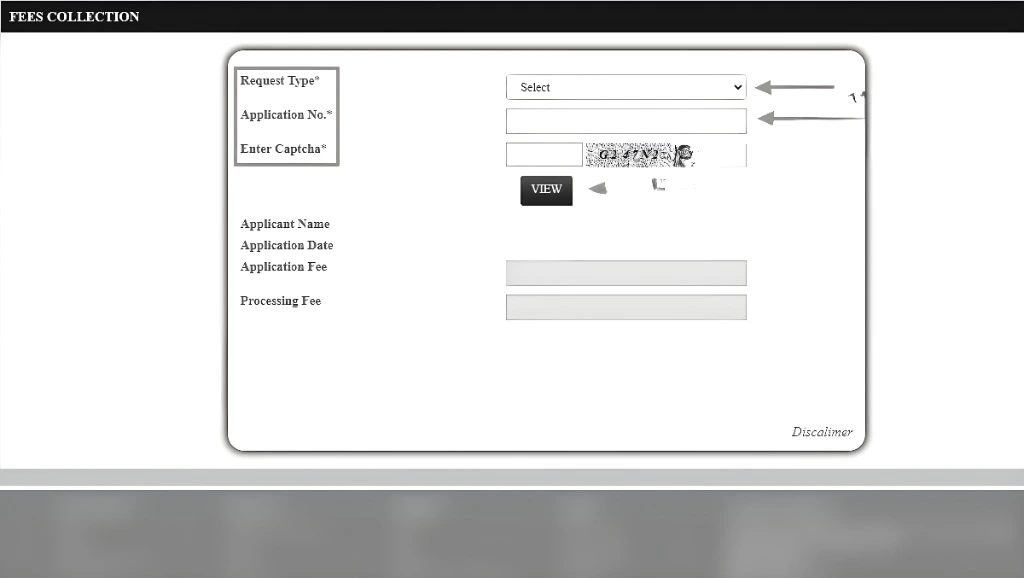

Payment Methods

Payments for Banglarbhumi services can be made through:

It’s advisable to use online payment methods for quicker processing and to receive instant receipts.

Refund Process

If you believe you’ve overpaid or need to cancel a transaction:

- Visit the West Bengal Finance Department’s website.

- Navigate to “e-Payment and Refund” under “e-Services”.

- Select “Application for Refund of e-Payment”.

- Fill in the required details and upload necessary documents.

- Submit a refund application at the registration office where the payment was made.

- Include the original payment receipt and any supporting documents.

Refunds are typically processed within 30 days, provided all documentation is in order.

Common Mistakes to Avoid During Property Transactions

Incorrect Documentation:

Ensure all required documents are submitted accurately, especially the sale deed and tax receipts.

Not Completing Both Processes: Many buyers only focus on property registration and neglect the mutation process. This can cause complications later, such as issues with property taxes or selling the property in the future.

Delay in Mutation: Not applying for mutation immediately after property registration can lead to delays in updating the land records, which might affect future transactions or property tax assessments.

Tips for a Smooth Transaction

Verify Property Details: Ensure all property information is accurate before initiating any process.

Keep Documents Ready: Have all necessary documents, such as identity proof, property papers, and photographs, prepared in advance.

Use Online Services: Opt for online services to save time and reduce the risk of errors.

Stay Updated: Regularly check the Banglarbhumi portal for any updates or changes in fees and procedures.

Understanding the Importance of Accurate Documentation

Accurate documentation is crucial for avoiding delays and complications during property transactions. Ensure that the following documents are in order:

Frequently Asked Questions

Conclusion

Understanding the updated document fees and processes for Banglarbhumi services in 2025 is crucial for property owners and prospective buyers in West Bengal. By staying informed and following the outlined procedures, you can ensure a smooth and efficient experience with land-related services.