Banglarbhumi Land Revenue Application and Khajna Payment2025

If you own land in West Bengal, paying your land revenue (commonly known as Khajna) is a crucial responsibility.

The Banglarbhumi Portal offers a streamlined and secure way to manage this process online. This guide will walk you through everything you need to know, from understanding land revenue to making Online,Khajna payment and tracking your Grievance application status.

What is Land Revenue (Khajna)?

Land revenue is a tax levied by the government on landowners. In West Bengal, this revenue supports various public services and infrastructure projects. The amount varies based on factors like land type, usage, and location. Regular payment ensures your property records are up-to-date and helps avoid legal complications.

How to Apply for Land Revenue (Khajna) Online

Access the Banglarbhumi Portal

Visit the official website: https://banglarbhumi.gov.in

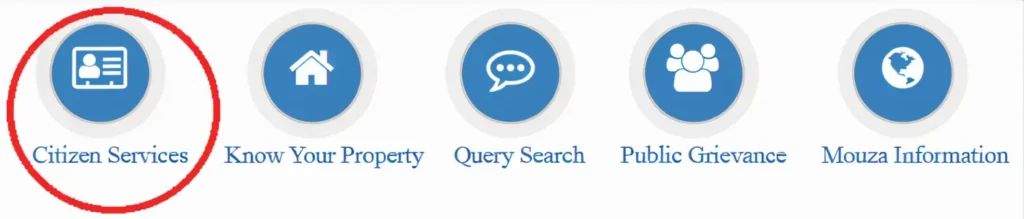

Navigate to ‘Citizen Services’

On the homepage, locate and click on the ‘Citizen Services’ tab.

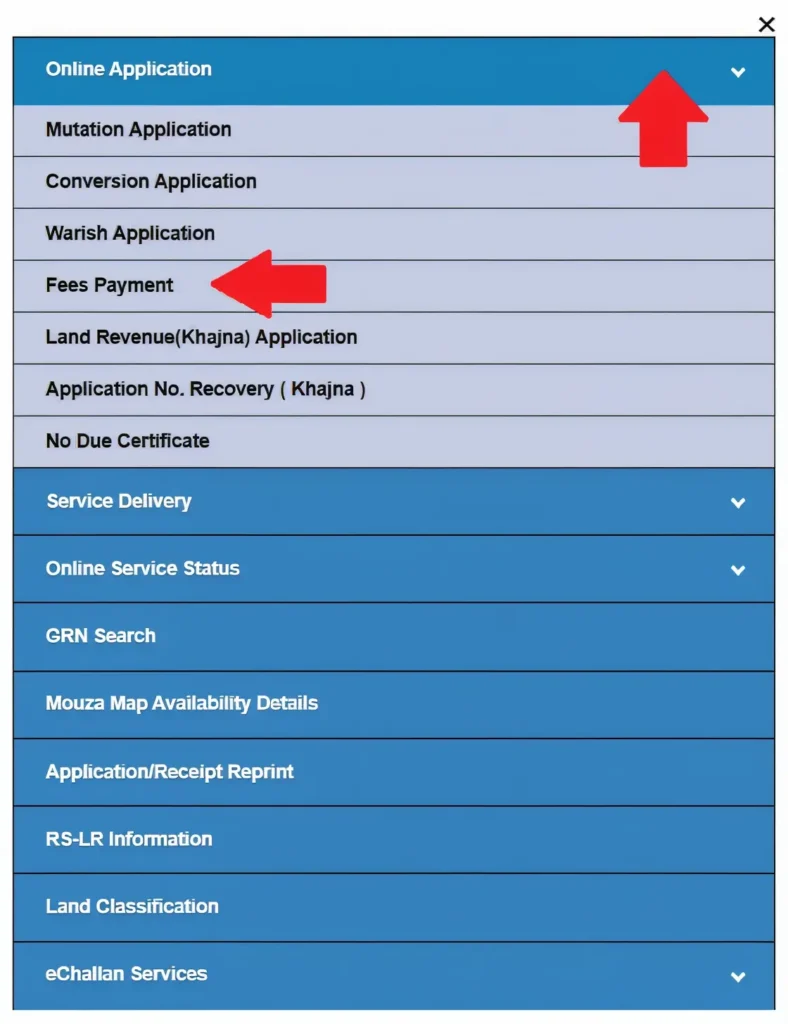

Select ‘Khajna (Land Revenue) Payment’

Under the Citizen Services menu, find and select ‘Khajna Payment’.

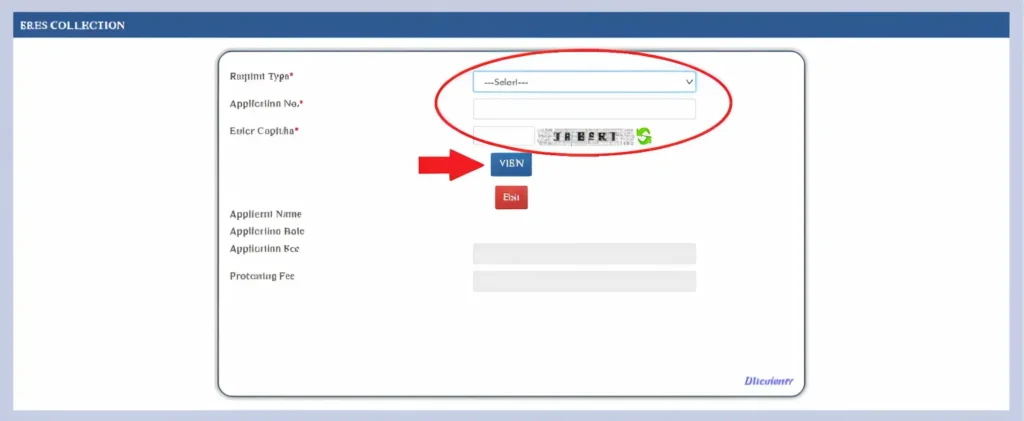

Enter Property Details

1.District (from dropdown)

2.Block

3.Mouza (village)

4.Khatian number (land ID)

5.Plot number

Verify and Calculate the Amount

After entering the details, the portal will display the land revenue amount due for your property.

Make the Payment

Click on ‘Pay Now’ to proceed.

1.Net Banking

2.Credit/Debit Cards

3.UPI (Unified Payments Interface)

Download Payment Receipt

Once the payment is successful, a receipt will be generated. Download and save this receipt for your records.

How to Pay Land Revenue Using the Banglarbhumi Mobile App

For added convenience, the Banglarbhumi Mobile App allows you to manage land revenue payments on the go. The app offers functionalities such as:

Download the app from the Google Play Store or Apple App Store to get started.

Consequences of Not Paying Land Revenue on Time

Before initiating your Khajna payment online or through the mobile app, it is essential to keep the following documents and details ready:

Khatian Number :

Unique identifier for your land records.

Plot Number :

Specific plot associated with your property.

Owner’s Details :

Name, contact information, and ID proof.

Banking Information :

For completing online transactions (Net Banking, Card, or UPI).

Previous Payment Receipt (if available) :

Useful for reference and verification.

Documents Needed for (Land Revenue) Khajna Payment

Failure to pay land revenue (Khajna) within the stipulated deadlines can lead to several issues:

Additional charges may apply for delayed payments.

Non-payment can affect ownership rights and create disputes.

You may face difficulties when applying for mutation, land conversion, or government schemes.

Unpaid revenue may result in outdated or invalid records in the Banglarbhumi system.

Tips for a Smooth Payment Process

Keep Property Details Ready:

Ensure you have your Khatian number, Plot number, and other relevant information before initiating the payment.

Verify Payment Status: After making the payment, check the status on the portal or app to confirm successful processing.

Save Your Receipt:

Always download and store your payment receipt for future reference.

Be Aware of Deadlines: Stay informed about payment deadlines to avoid penalties or fines.

Frequently Asked Questions

Final Thoughts

Paying your land revenue online through the Banglarbhumi Portal is a straightforward and secure process. By following the steps outlined in this guide, you can ensure your property records remain current and avoid potential legal issues. Regularly updating your land revenue payments also keeps you eligible for various government schemes and services.